- Tutorials

Save on VAT with ColisExpat’s Off Tax solution

Dear Overseas Customers,

At ColisExpat, we strive to make online shopping easier for residents in the French overseas territories (DOM-TOM). Today, we’re proud to introduce our Off Tax service.

This solution is designed to help you avoid paying VAT on orders from France. We understand how much this tax can increase your costs—that’s why we’ve worked hard to create an efficient and accessible option for all our overseas customers.

With the Off Tax option, you can now shop tax-free on a selection of French e-commerce sites like Amazon FR, FNAC, La Redoute, and more (see the full list below).

⚠️ Please note: This service is not automatic. To benefit from it, you must carefully follow the detailed steps before forwarding any parcel.

Websites eligible for the Off Tax service

As of now, our Off Tax service is available for 24 French e-commerce websites:

AMAZON FRANCE

FNAC

LA REDOUTE

CDISCOUNT

SEPHORA FRANCE

PRINTEMPS

SHOWROOMPRIVE

GALERIES LAFAYETTE

BOULANGER

AUTODOC FRANCE

SAMSUNG FRANCE

DARTY

COURIR

3 SUISSES

DECATHLON

VEEPEE

DYSON FRANCE

FOOT LOCKER

LDLC

PETIT BATEAU

VERTBAUDET

BAZARCHIC

MAXICOFFEE

PLACE DES TENDANCES

This list will continue to grow, giving you even more options.

How does Off Tax work?

Before placing an order

Avant de passer commande sur l’un des 24 sites éligibles, voici les étapes à suivre.

1. Sign up and complete your profile on ColisExpat

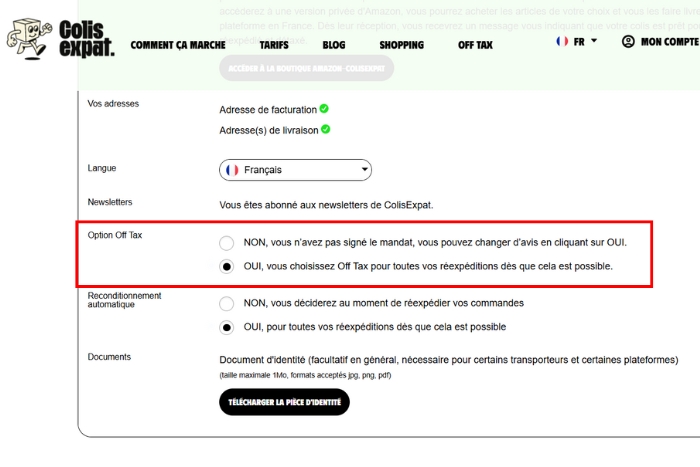

Be sure to enter your overseas (DOM-TOM) address in the “Shipping Addresses” section of your profile. Once this address is saved, a new “Off Tax” section will appear in your account. Make sure to activate the option.

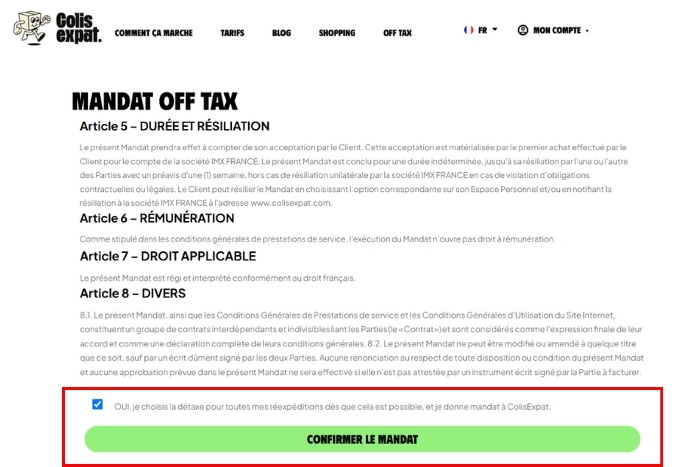

2. Accept the Off Tax Mandate

Once the Off Tax option is activated, the Off Tax mandate will automatically appear. You’ll need to read and confirm it.

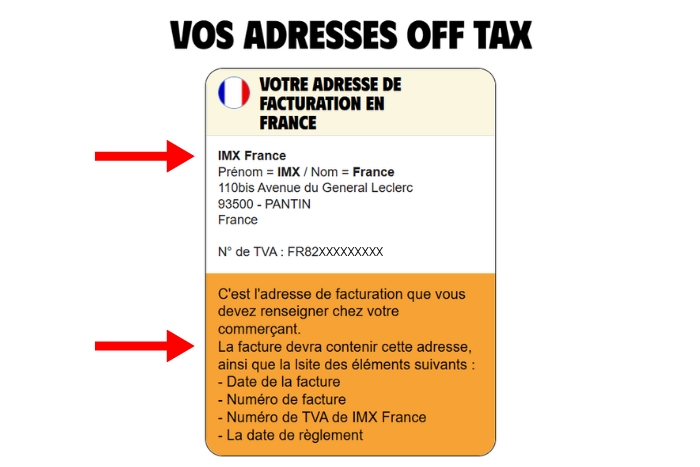

3. Go to the “My Off Tax Addresses” section to:

- Understand the eligibility conditions

- Learn how to correctly fill in your billing and shipping addresses

- Check the mandatory information that must appear on the merchant invoice for your order to qualify for tax exemption

During your order

4. Shop on one of the eligible e-commerce sites

Browse one of the 24 websites eligible for the Off Tax option (see the list above).

Place an order with a subtotal (excluding VAT) between €50 and €1,000. Only orders within this range are eligible.

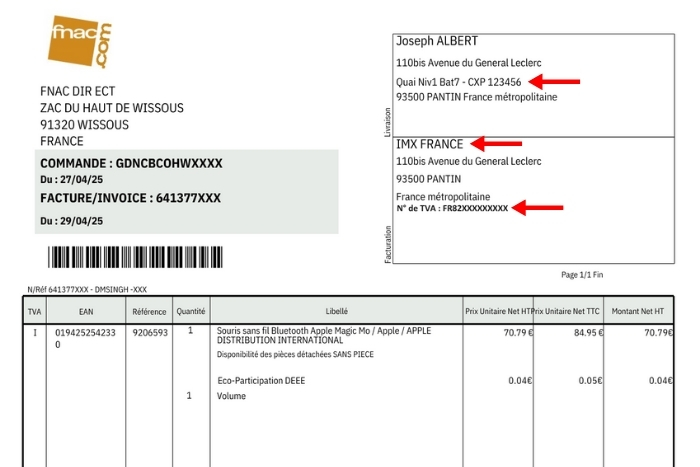

5. Issue the invoice in the name of IMX FRANCE

Have the invoice issued in the name of IMX FRANCE (our parent company). Your name should not appear on it—IMX FRANCE acts as your representative to activate the tax exemption.

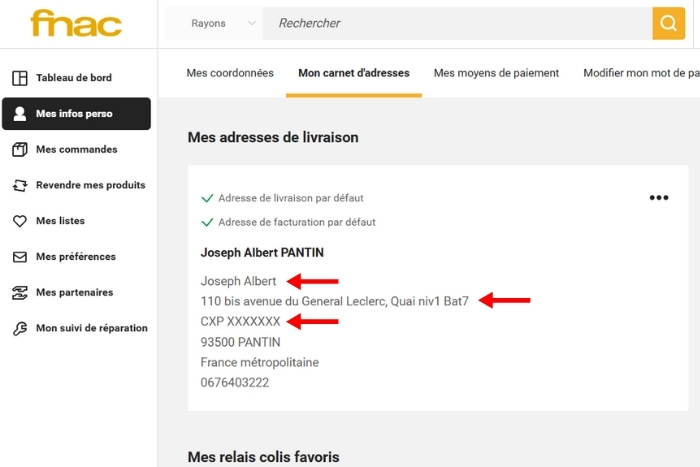

6. Ship your package to our ColisExpat warehouse in France

Use your ColisExpat delivery address in France and include your full name and ColisExpat client reference. This information is essential for identifying your parcel.

7. Pay the full price (including VAT)

Complete your purchase by paying the full amount including VAT, and wait for your package to be delivered to our ColisExpat warehouse.

Once your package has been received by ColisExpat

8. Delivery notification in your Client Space

Once received, your package will appear under the “My Packages in Stock” section of your ColisExpat account.

9. Fill out your customs declaration

Complete your customs declaration, just as you would for any other shipment—this step remains unchanged.

10. Upload the merchant invoice in the name of IMX FRANCE

If you’ve followed all the previous steps and your order is eligible, a new icon called “Off Tax Declaration” will appear in your client space.

Upload the invoice made out to IMX France, clearly showing both the VAT-inclusive (TTC) and VAT-exclusive (HT) amounts.

If you haven’t received it yet, request it from the merchant.

If you have several invoices or if one shipment (e.g. from Amazon) contains multiple products, you must merge all invoices into a single PDF file (maximum 1MB), as only one file can be uploaded.

11. Invoice validation by our team

Our team will review the invoice for compliance. This validation is mandatory before any shipment to the DOM-TOM.

Once your package has been received by ColisExpat

12. Invoice Validation

If your invoice is approved, you’ll receive a confirmation email and can proceed with the forwarding of your package. The tax exemption will be applied at that point, and ColisExpat will refund the VAT you initially paid, minus a small service fee.

If the invoice is rejected, no modifications can be made. You’ll then need to forward the parcel without any tax refund.

Good to Know

The Off Tax option requires following a specific process, which may be a bit of a hassle for some customers.

That’s why we’ve developed two alternative solutions for making tax-free purchases:

Our ColisExpat Extension for Amazon: a plugin that integrates directly into your browsing experience on the official Amazon.fr website. You shop as usual, while being notified in real time whether your cart is eligible for tax exemption and how much you can save with ColisExpat.

Our Private Amazon Store: a dedicated platform accessible from your ColisExpat account, where everything is pre-configured for tax-free shopping—no extra steps required.

Both tools help you identify tax-exempt products, calculate your savings, and simplify the entire process. No need to validate invoices or follow complex procedures—we handle everything for you, and delivery to our warehouse is included.

If you have any questions or concerns, visit our dedicated FAQ page. We’re here to help you every step of the way.

At ColisExpat, we’re always striving to make your online shopping simpler, more affordable, and more enjoyable. Off Tax is our latest addition to offer you an exceptional shopping experience. Try it out now and discover why we deliver the world at the best prices on the market!

The ColisExpat Team

#OffTax #ColisExpat #VATFreeShopping #ShoppingMadeEasy